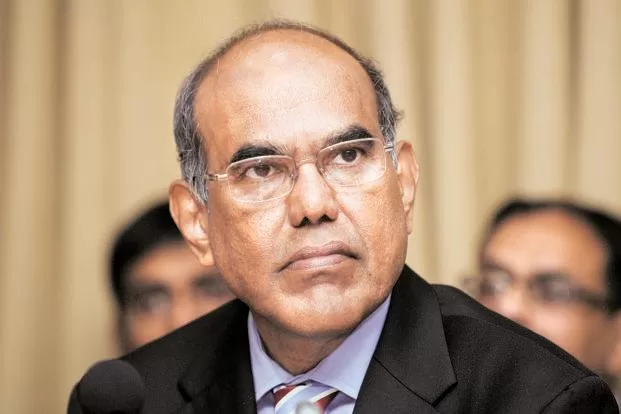

Former RBI Governor speaks up against Finance Ministry under the leadership of Pranab Mukherjee and P Chidambaram

In his recent book titled 'Just A Mercenary?: Notes from My Life and Career', Subbarao criticizes the government's lack of understanding and respect for the autonomy of the central bank.

Agnibeena Ghosh /17th April 2024

Former Reserve Bank of India (RBI) Governor Duvvuri Subbarao has made startling revelations in his memoir, shedding light on the persistent pressure exerted by the Finance Ministry, under the leadership of Pranab Mukherjee and P Chidambaram, to influence the central bank’s decisions regarding interest rates and economic projections.

In his recent book titled ‘Just A Mercenary?: Notes from My Life and Career’, Subbarao criticizes the government’s lack of understanding and respect for the autonomy of the central bank. Drawing from his experience as both finance secretary (2007-08) and RBI governor (2008-2013), he highlights instances where the government sought to undermine the RBI’s independence.

In a chapter titled ‘Reserve Bank as the Government’s Cheerleader?’, Subbarao recounts how pressure from the government extended beyond the RBI’s monetary policy stance to include economic growth and inflation forecasts. He recalls a specific incident during Pranab Mukherjee’s tenure as finance minister, where government officials challenged the RBI’s assessments with their own assumptions and estimates, urging for a more optimistic outlook to boost public sentiment.

Subbarao expresses his discomfort with the government’s insistence that the RBI act as a cheerleader for its policies, emphasizing the importance of maintaining the central bank’s credibility by adhering to objective assessments. He asserts that the RBI cannot compromise its professional judgment to manipulate public sentiment, as doing so would undermine its credibility and effectiveness.

Moreover, Subbarao reveals clashes with both Chidambaram and Mukherjee regarding the RBI’s policy stance, noting their persistent advocacy for lower interest rates despite his resistance. While Chidambaram employed his legal acumen to argue his case, Mukherjee, as a seasoned politician, delegated the task to his officers, leading to strained relations between the RBI and the Finance Ministry.

Subbarao recalls a particularly tense period in October 2012, when Chidambaram, upon returning as Finance Minister, intensified efforts to counteract the fiscal laxity of the previous regime. Despite immense pressure to ease monetary policy, Subbarao remained steadfast in his commitment to maintaining a prudent approach, much to the dismay of Chidambaram, who publicly criticized the RBI’s stance.

The former RBI governor’s memoir offers a candid glimpse into the complex dynamics between the central bank and the government, highlighting the delicate balance between autonomy and political influence. Subbarao’s account underscores the challenges faced by central bankers in upholding their institution’s independence while navigating the pressures of economic policy-making.

As India’s financial landscape continues to evolve, Subbarao’s memoir serves as a timely reminder of the importance of safeguarding the autonomy of institutions like the RBI in preserving economic stability and credibility. It also prompts reflection on the need for greater mutual understanding and cooperation between regulatory bodies and policymakers to ensure the nation’s economic well-being.