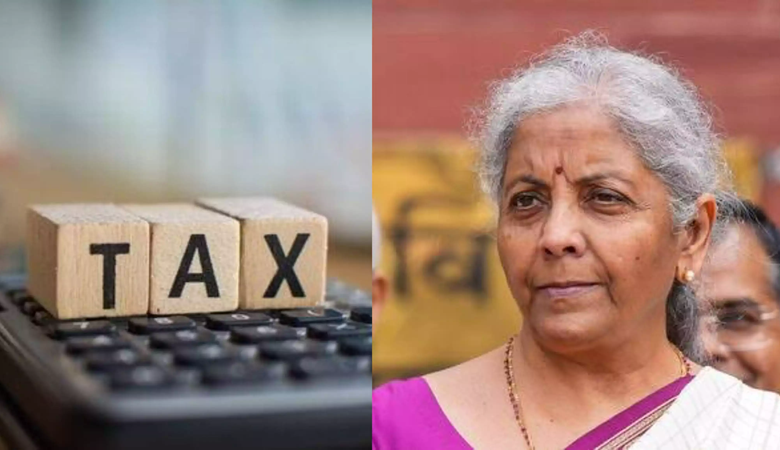

Nirmala Sitharaman Discusses Budget 2024: Relief for Middle Class, GST Benefits, and Capital Gains Tax

News Mania Desk/Agnibeena Ghosh/25th July 2024

On July 23, 2024, Finance Minister Nirmala Sitharaman made history by presenting her seventh consecutive budget. In an exclusive interview with Times Network Editor-in-Chief Navika Kumar, Sitharaman addressed critical issues and concerns surrounding the latest budget, which is the Modi government’s first comprehensive budget since its third-term victory.

Sitharaman acknowledged the concerns of the middle class, emphasizing her commitment to providing relief despite certain constraints. “I want to relieve the middle class, but I have limitations too,” she stated. To address these concerns, the standard deduction rate has been increased from Rs 50,000 to Rs 75,000. Sitharaman explained that this adjustment aims to reduce the tax burden on the middle class, while also ensuring that higher income earners contribute their fair share. The new tax regime, introduced with lower tax rates compared to the old one, is part of this effort to ease the financial strain on middle-class families.

Speaking about the Goods and Services Tax (GST), Sitharaman highlighted her personal connection to the middle class, saying, “I am also from the middle class…and understand their problems.” She elaborated on how GST has standardized the prices of essential goods across the country, providing significant relief to the common people. Before GST, different states imposed their own taxes on essential items, leading to varied prices nationwide. The establishment of the GST Council has ensured uniform pricing, benefiting consumers across India.

The interview also covered the increase in long-term capital gains tax from 10% to 12.5%, a notable change in the 2024 budget. Sitharaman reassured small investors that income up to Rs 1.25 lakh remains tax-free, and the removal of indexation would not negatively impact them. She justified the increase in the capital gains tax rate by pointing out that many small investors, despite earning more, paid less tax under the previous regime. The new tax rate aims to address this discrepancy and ensure a fairer distribution of tax liabilities.

This budget marks a significant step for the Modi government as it embarks on its third term. Sitharaman’s efforts to balance relief for the middle class with fiscal responsibility are evident in the changes she has implemented. By increasing the standard deduction and adjusting the tax regime, she aims to provide tangible benefits to the middle class while ensuring that high-income earners pay their fair share.

The GST reforms continue to play a crucial role in stabilizing prices and providing relief to consumers. By eliminating state-specific taxes and ensuring uniform pricing, the GST Council has made essential goods more affordable for the common people. This standardization is a key component of the government’s strategy to support the middle class and promote economic stability.

The increase in long-term capital gains tax reflects the government’s commitment to a fair and equitable tax system. By raising the tax rate and removing indexation, the government aims to ensure that all investors contribute appropriately to the nation’s finances. This approach seeks to balance the need for revenue with the goal of maintaining investor confidence and supporting economic growth.

Overall, Sitharaman’s seventh budget presentation underscores her dedication to addressing the concerns of the middle class, ensuring fair taxation, and promoting economic stability. Her comprehensive approach reflects the Modi government’s broader vision for India’s economic future, aiming to provide relief to citizens while maintaining fiscal responsibility. As the government moves forward, these measures will play a crucial role in shaping the economic landscape and supporting the aspirations of the Indian people.