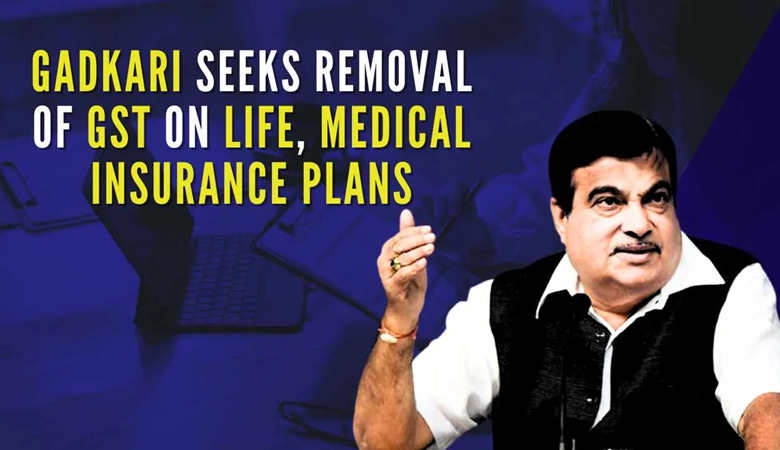

Nitin Gadkari Urges Removal of 18% GST on Life and Medical Insurance Premiums

News Mania Desk/Agnibeena Ghosh/31st July 2024

Union Minister Nitin Gadkari has formally requested Finance Minister Nirmala Sitharaman to reconsider and withdraw the 18 percent Goods and Services Tax (GST) imposed on life and medical insurance premiums. Gadkari articulated his concerns in a letter sent on Wednesday, following a memorandum he received from the Nagpur Division Life Insurance Corporation Employees Union, highlighting critical issues affecting the insurance industry.

In his correspondence to the Finance Minister, Gadkari underscored the union’s significant concerns regarding the burdensome GST on insurance premiums. The Road Transport and Highways Minister emphasized that applying an 18 percent GST on life insurance premiums effectively taxes the uncertainties and inherent risks associated with life. He pointed out that insurance serves as a crucial safety net for individuals and their families, mitigating the financial impact of life’s unpredictable events. Therefore, taxing these premiums is essentially penalizing people for seeking protection against life’s inherent risks.

Gadkari elaborated on the union’s perspective, noting that individuals who invest in life insurance to safeguard their families should not be burdened with additional taxes on their premiums. This taxation, according to the union, discourages people from securing life insurance coverage, which is vital for providing financial security to their dependents. Moreover, the 18 percent GST on medical insurance premiums is seen as a significant impediment to the growth of the health insurance sector. Given the social necessity of medical insurance, the union contends that the high GST rate is counterproductive and inhibits broader adoption of health insurance policies, which are essential for managing healthcare costs.

Highlighting the broader implications, Gadkari stated that removing the GST on life and medical insurance premiums would make these essential services more accessible and affordable. This move would encourage more people to purchase insurance, thereby enhancing financial protection for families and promoting the growth of the insurance sector. In his letter, Gadkari argued that such a measure is especially important for senior citizens, who often find it challenging to afford the high costs associated with insurance premiums, compounded by the added GST.

The Nagpur Division Life Insurance Corporation Employees Union’s memorandum to Gadkari included several other relevant points, urging the government to recognize and address the challenges faced by the insurance industry. These points, though not specified in detail in Gadkari’s letter, reflect a broader call for policy reforms to support and stimulate the insurance market in India.

Gadkari concluded his letter by urging the Finance Minister to prioritize the withdrawal of GST on life and medical insurance premiums, citing the cumbersome nature of the current tax rules, especially for senior citizens. He stressed that such a policy change would align with the broader objective of making essential financial products more accessible to the general populace.

In summary, Nitin Gadkari’s appeal to Nirmala Sitharaman represents a significant push towards alleviating the tax burden on life and medical insurance premiums. By advocating for the removal of the 18 percent GST, Gadkari aims to make insurance more affordable and encourage wider adoption, ultimately providing greater financial security for Indian families and supporting the growth of the insurance industry. This call for action highlights the critical role of government policy in shaping the accessibility and affordability of essential financial services.