RBI Policy Holds Interest Rates Steady for Ninth Time Amid Persistent Food Inflation Concerns

News Mania Desk/Agnibeena Ghosh/8th August 2024

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has decided to maintain the Repo rate at 6.5% for the ninth consecutive time, driven by ongoing concerns over stubborn food inflation. In its meeting held on August 8, the rate-setting panel also kept the monetary policy stance unchanged at ‘withdrawal of accommodation,’ reflecting a cautious approach amidst economic uncertainties.

This decision means that banks are likely to keep interest rates steady, providing relief to borrowers who can expect their equated monthly installments (EMIs) on loans, such as home and personal loans, to remain unchanged. Despite the persistent inflationary pressures, the RBI has kept its projections for the country’s economic performance steady, with the GDP growth forecast for FY2025 unchanged at 7.2% and retail inflation expected to be around 4.5%.

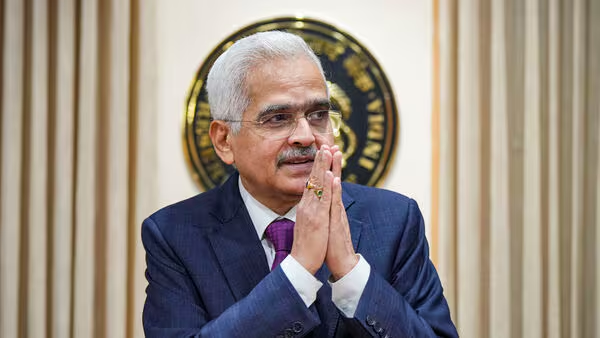

The MPC’s choice to keep the policy rate unchanged comes amid ongoing concerns about elevated food inflation, which has been a significant factor in driving up overall retail inflation. In June, the headline inflation, measured year-on-year through the all-India consumer price index (CPI), rose to 5.1% from 4.8% in May. This increase was largely driven by food inflation, which escalated to 8.4% in June, up from 7.9% in the previous month. According to RBI Governor Shaktikanta Das, the food component continues to be a major contributor to retail inflation, accounting for approximately 70% of the total inflation figure.

Governor Das emphasized the importance of price stability in achieving high economic growth, underlining the MPC’s vigilance to prevent spillover effects from persistent food inflation. The RBI operates under a flexible inflation targeting regime, aiming to keep CPI within a 2-6% range, with a long-term goal of bringing inflation down to 4% on a sustainable basis. However, the ongoing food inflation presents a significant challenge to this objective, necessitating a cautious approach in monetary policy.

Analysts and economists are closely watching the RBI’s moves, with many predicting that any potential rate cuts may not occur until December 2024. This cautious stance is informed by concerns over the uneven monsoon, which could further exacerbate food inflation, as well as global economic uncertainties, including geopolitical risks and fluctuations in the rupee’s value.

Despite the steady Repo rate, there is a possibility that lenders might increase interest rates on loans tied to the marginal cost of fund-based lending rate (MCLR), as the full transmission of the 250-basis-point hike in the repo rate since May 2022 has not yet been realized. This could result in marginal increases in deposit rates in certain segments, as credit growth has lagged behind deposit growth in recent months.

Looking ahead, some economists believe that the RBI might consider a rate cut in December 2024, depending on how the food inflation outlook evolves and the overall economic environment. If the second half of the monsoon season brings a normal distribution of rains and no major global or domestic shocks occur, a change in the RBI’s stance could be on the horizon. This could potentially be followed by gradual rate cuts, leading to further easing of monetary policy.

Global events, particularly those affecting the US Federal Reserve’s rate decisions, could also influence the RBI’s future actions. Expectations of rate cuts by the Federal Reserve have risen, which could prompt the RBI to align its policies with global trends to avoid significant deviations.