Adani Group Addresses Media Speculation on Succession Plan: Claims Misquoting

News Mania Desk/Agnibeena Ghosh/7th August 2024

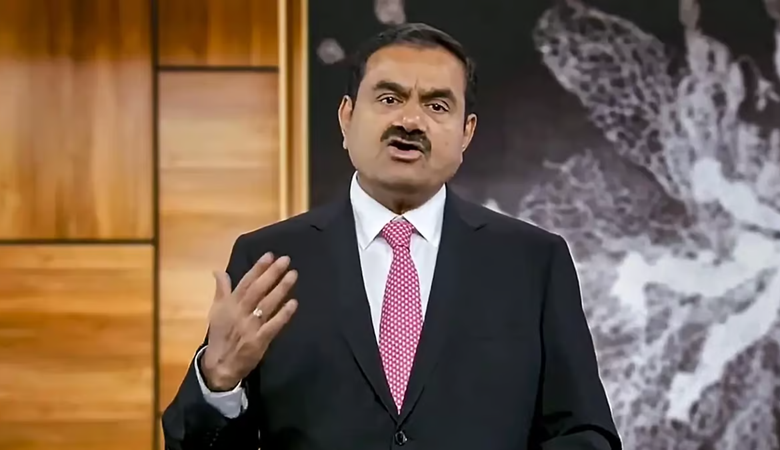

The Adani Group has recently issued a statement to address various media reports regarding the succession plan of its billionaire chairman, Gautam Adani. According to the company’s clarification, Adani has been inaccurately quoted concerning the details of the succession plan and the role of his heirs within the family trust. This response aims to correct misunderstandings arising from recent media coverage.

The clarification came via an official exchange filing, where the company emphasized that Gautam Adani’s remarks on succession planning were misrepresented. Adani had discussed the importance of a systematic and gradual approach to succession, rather than presenting it as a singular event. His perspective focused on ensuring the long-term sustainability of the business through a well-organized transition process.

In a recent Bloomberg interview, Adani was reported to have stated that upon his retirement, his four heirs—sons Karan and Jeet, along with cousins Pranav and Sagar—would receive equal shares in the family trust. The report suggested that he planned to transfer control to his sons and cousins by the early 2030s, with a confidential agreement in place to manage the stake transfers within the conglomerate’s various companies.

However, Adani Enterprises has clarified that no specific timeline was provided by Adani regarding the succession process. The company’s statement refuted claims about the heirs’ equal beneficial interest in the family trust, pointing out that Adani had only discussed the involvement of his sons and nephews in the group’s business operations. This clarification underscores that the media reports did not accurately reflect Adani’s views or plans.

The company’s share price experienced a decline following the initial media reports. Adani Enterprises noted that the fluctuations in share price are influenced by market dynamics and that the management does not control or have specific insights into the reasons behind such movements. It is also worth mentioning that the broader stock market witnessed a correction of 3 percent during the same period.

On the following trading day, Adani Enterprises’ stock rebounded, showing a gain of 3.4 percent and reaching an intraday high of Rs 3,177.05 per share on the National Stock Exchange (NSE). This recovery indicates that investor sentiment may have stabilized following the company’s clarification and the broader market correction.

Overall, the Adani Group’s clarification serves to address inaccuracies in media reports about the succession plan, emphasizing a commitment to a structured and gradual transition process rather than the abrupt changes previously suggested. The company’s proactive response aims to ensure that shareholders and the public have a clear understanding of the succession strategy and its implementation.